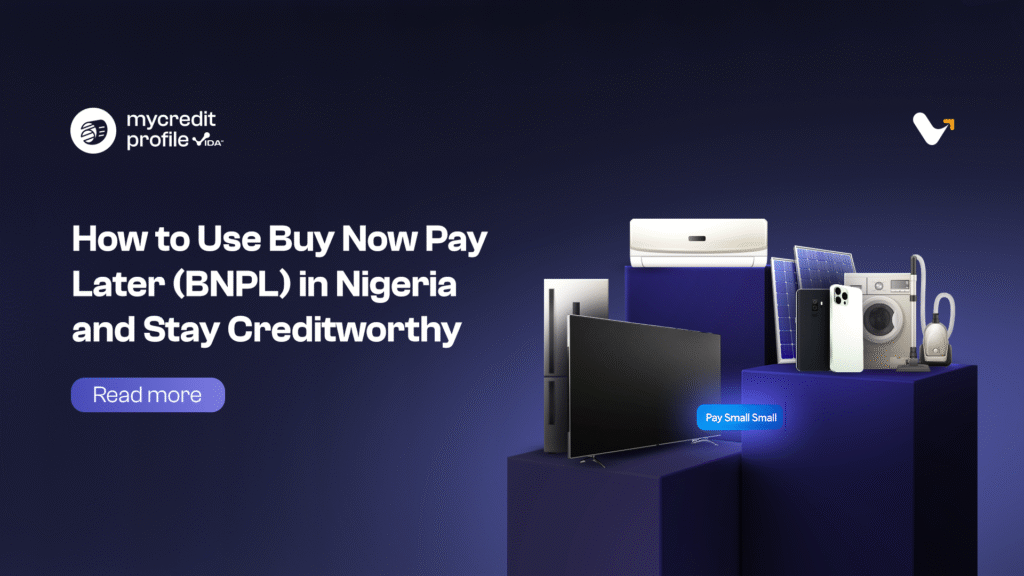

Buy Now Pay Later (BNPL) is reshaping how Nigerians shop and manage their finances. You can purchase items (phones, laptops, solar panels, home appliances, furniture) today and split the payments over weeks or months. It’s convenient and accessible. But here’s the catch: misusing BNPL damages your credit profile and locks you out of better financial opportunities.

This guide shows you how to use Buy Now Pay Later in Nigeria without harming your creditworthiness.

Understanding Buy Now Pay Later in Nigeria

What exactly is Buy Now Pay Later? It’s a payment method that lets you split purchases into smaller installments without paying interest (usually). You buy now, pay later in equal portions.

Popular BNPL platforms in Nigeria include Veend, Credit direct, and others. They partner with merchants to offer this flexibility at checkout.

Why do Nigerians use Buy Now Pay Later?

- You spread costs across multiple months

- No large upfront payment required

- Quick approval process

- Access to products you want immediately

But here’s what matters: every BNPL transaction gets recorded. Lenders track your BNPL activity. Credit bureaus monitor your payment behavior. One missed payment can lower your credit score.

This is where your credit profile becomes critical.

How Buy Now Pay Later Affects Your Credit Profile

Your credit profile reflects your financial reliability. When you use Buy Now Pay Later, lenders see:

- How many loan & BNPL agreements you have active

- Whether you pay on time

- Your total monthly credit obligations

- Your repayment consistency

Missing even one BNPL payment signals risk. Lenders worry. Your credit profile suffers. Loan approvals become harder. Better interest rates disappear.

A strong credit profile, built through responsible BNPL use, opens doors. You qualify for better loans. You access premium BNPL services. Employment opportunities improve. That’s the power of creditworthiness.

5 Strategies to Use Buy Now Pay Later Responsibly

1. Know the Terms Before You Commit

Read everything. Don’t rush through the fine print.

Ask yourself:

- What’s the total repayment period?

- Are there late fees?

- What happens if I miss a payment?

- Does this platform report to credit bureaus?

Reputable BNPL providers clearly display terms upfront. If information feels hidden or unclear, walk away. You need transparency to make smart decisions about your credit profile.

2. Use Buy Now Pay Later for Planned Purchases Only

Stop using BNPL for impulse buys. That new gadget you saw online? That expensive outfit on sale? Pause. Think.

Reserve Buy Now Pay Later for:

- Essential household items you’ve planned for

- Work-related equipment you need

- Investments in your education or skills

Planned purchases align with your budget. You know you can repay. Your credit profile stays healthy.

3. Limit Your Active BNPL Agreements

You might get approved for multiple BNPL plans simultaneously. Don’t use them all. Multiple active agreements create risk.

Why? When you have three or four BNPL payments due each month, mistakes happen. You forget a date. A transaction fails. Suddenly, your credit profile takes damage.

Keep it simple. Limit active BNPL agreements to one or two at any time. This keeps your finances manageable and your credit profile strong.

4. Set Up Payment Reminders and Auto-Debit

Late payments destroy creditworthiness. They don’t destroy it slowly, they demolish it fast.

Your action steps:

- Enable auto-debit on your bank account

- Set phone reminders three days before each due date

- Use calendar alerts

- Ask your BNPL provider about payment notifications

Consistency builds a powerful credit profile. Every on-time payment counts. Lenders notice. Your credit score climbs. Your eligibility for better financial products increases.

5. Monitor Your Credit Profile Continuously

You can’t improve what you don’t measure. Check your credit profile regularly.

MyCreditProfile helps you:

- See your complete financial health snapshot

- Understand exactly how BNPL affects your creditworthiness

- Receive AI-powered insights into improving your credit score

- Get professional documentation for loan applications and employment

When you track your credit profile, you catch problems early. You see trends. You make adjustments before damage happens.

The Real Cost of Misusing Buy Now Pay Later

One bad decision ripples across your entire financial life. Miss three BNPL payments, and:

- Your credit profile drops significantly

- Loan applications get rejected

- BNPL platforms block you from future purchases

- Better interest rates disappear

You don’t want this. Your creditworthiness is your financial passport. Protect it.

Start Building Your Credit Profile Today

Buy Now Pay Later works best when you’re intentional. Use it strategically. Pay on time. Stay disciplined. Track your credit profile.

MyCreditProfile gives you the professional financial documentation you need to qualify for better BNPL services, loans, and opportunities. Your credit profile is more than a score, it’s proof of your financial responsibility. Create your comprehensive credit profile now.