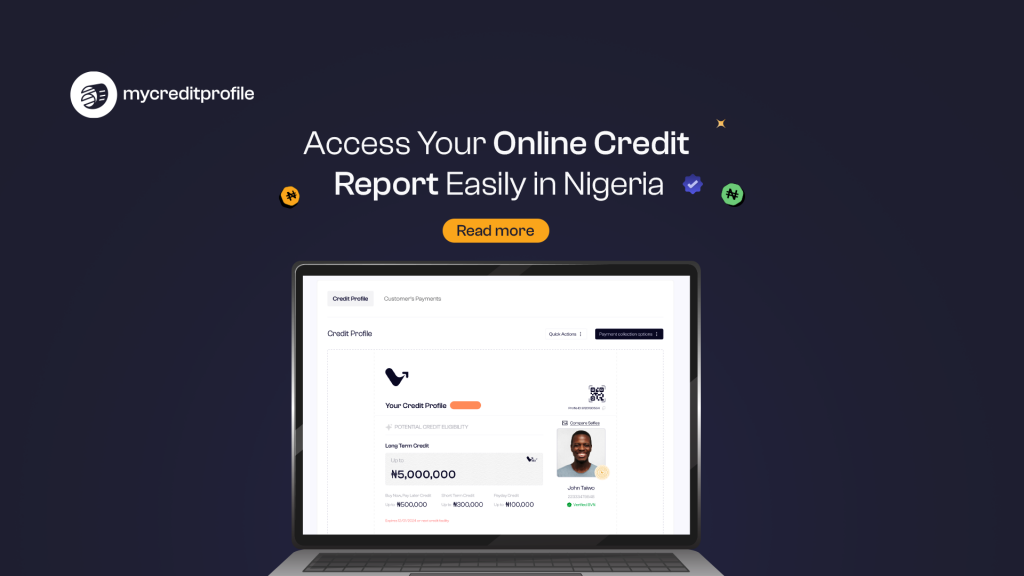

Nigerians are embracing financial technology at record speed, and one of the most important aspects of this digital shift is access to personal credit information. Understanding your credit profile is no longer reserved for bankers and financial analysts. It’s now a tool every Nigerian can and should use to unlock better financial opportunities including BNPL (Buy Now, Pay Later) options and instant credit.

For years, accessing your credit report in Nigeria involved tedious processes with limited transparency. But today, platforms like mycreditprofile.me are changing the game. With a few clicks, users can generate a comprehensive credit profile that connects them to a wide network of lenders and merchants across the country.

Why Your Credit Profile Matters

Your credit profile is the financial identity you use to access credit products such as personal loans, overdrafts, BNPL services, and flexible payment terms. It reflects your past borrowing behavior, repayment history, and overall financial health. Lenders rely on it to assess your creditworthiness before approving a loan or extending instant credit.

Without a reliable way to access and manage this information, consumers can be left in the dark, unaware of how their financial behavior affects their ability to secure funding.

Instant Credit Access in a Digital Age

mycreditprofile.me bridges this gap by offering Nigerians a fast, secure, and comprehensive way to view their credit standing. Through this ai powered platform, users can:

- Create a digital credit profile in minutes

- Instantly access real-time credit reports

- Connect with lenders offering quick loans based on individual profiles

- Take advantage of BNPL services at partner merchants

This centralized access means you no longer have to apply separately with multiple lenders. Once your credit profile is created, the platform does the work of matching you with the best options based on your financial history and needs.

How BNPL Works with Your Credit Profile

BNPL is quickly becoming a preferred method of payment for online shoppers in Nigeria. Whether it’s electronics, household items, or educational services, spreading out payments over time without heavy upfront costs appeals to many. But behind every successful BNPL approval is a strong, verifiable credit profile.

Platforms like mycreditprofile.me empower consumers to qualify for these flexible payment options by making their financial background visible and verifiable. Merchants and BNPL providers gain confidence in the buyer’s creditworthiness, speeding up the approval process and ensuring higher conversion rates at checkout.

The Role of Data in Credit Decisions

Modern credit scoring goes beyond traditional metrics. Your credit report on mycreditprofile.me doesn’t just reflect loans and credit card usage; it includes broader indicators of financial responsibility such as bill payments, income verification, and spending behavior. This alternative data helps bring more Nigerians especially the underbanked into the formal credit system.

By using this holistic view of your financial life, lenders can approve instant credit more confidently, and you can enjoy access to funds when you need them most.

Safe and Transparent Credit Insights

Privacy and security are a top concern when dealing with financial data. mycreditprofile.me, powered by Vida, uses bank-level encryption and data protection standards to ensure your information is safe. The platform is also built on transparency. You see exactly what lenders see, giving you control over how your credit information is used.

Additionally, updates to your credit report happen in real-time. You can monitor changes, track your eligibility for new products, and take proactive steps to improve your score if needed.

Who Can Benefit from an Online Credit Profile?

- Salaried Employees seeking low-interest personal loans

- Business Owners wanting to access working capital

- Students and Young Professionals looking for flexible BNPL payment plans

- First-Time Borrowers establishing their financial identity

- Freelancers and Gig Workers with non-traditional income streams

Whether you’re purchasing on credit, applying for a loan, or simply wanting to understand your financial position better, having a real-time, comprehensive credit profile changes the game.

Take Control of Your Financial Future

A strong credit profile opens doors. It’s not just about loans and interest rates, it’s about choice, flexibility, and financial confidence. With instant access to your credit report and the ability to connect directly with lenders and BNPL providers, you’re no longer at the mercy of guesswork or limited financial products.

Now is the time to build and manage your credit identity.

Get started today at mycreditprofile.me and unlock access to instant credit, flexible BNPL offers, and a smarter way to manage your financial journey.