How to Qualify for Instant Loans with a Strong Credit Profile

Getting approved for instant loans has become much easier when you have a solid credit profile. Your credit score opens doors to better loan…

Buy Now Pay Later for Everyday Essentials: Is It Worth It?

Rising prices and unexpected expenses often put pressure on how people manage their daily lives. Rather than delay critical purchases or…

Buy Now Pay Later: The Future of Flexible Spending

The way people shop is evolving. Consumers no longer need to wait until payday or rack up high-interest credit card debt just to purchase what…

Buy Now, Pay Later: Unlock Flexible Payment Options for Everyday Needs

Making purchases today doesn’t always have to mean draining your account. From groceries and smartphones to fashion and tech, more Nigerians…

Buy Now, Pay Later: How to Shop Smart Without Breaking the Bank

Smart shopping today goes beyond hunting for deals. It’s about using financial tools that stretch your money without creating long-term debt.…

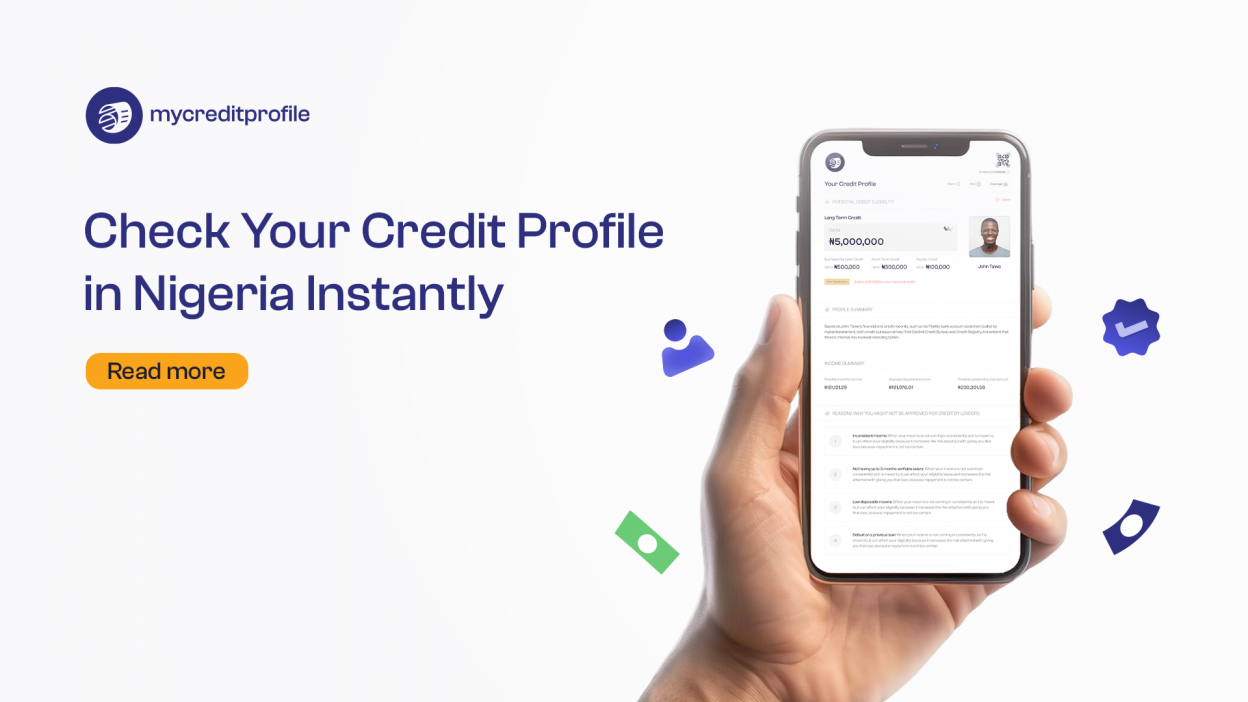

Credit Profile Check: Why It’s Important for Your Financial Health

One of the most effective ways to take control of your financial well-being is through a credit profile check. Understanding your credit…

Compare Credit Reports: What You Should Look for in Nigeria

When evaluating your financial options in Nigeria today, your credit report plays a crucial role in determining the kind of loans, BNPL…

Steps to Achieve a Good Credit Score in Nigeria

Building a reliable credit profile in Nigeria is no longer just an option for the financially savvy. It’s now essential for accessing instant…

What Does Credit Profile Mean in Nigeria?

In Nigeria’s evolving financial ecosystem, having a credit profile is becoming just as important as having a bank account. For years, access…

How Nigerian Lenders Assess Your Credit Profile

Before a lender approves any form of instant credit or a BNPL offer, they need to answer one question “can this person pay back?”…